Description

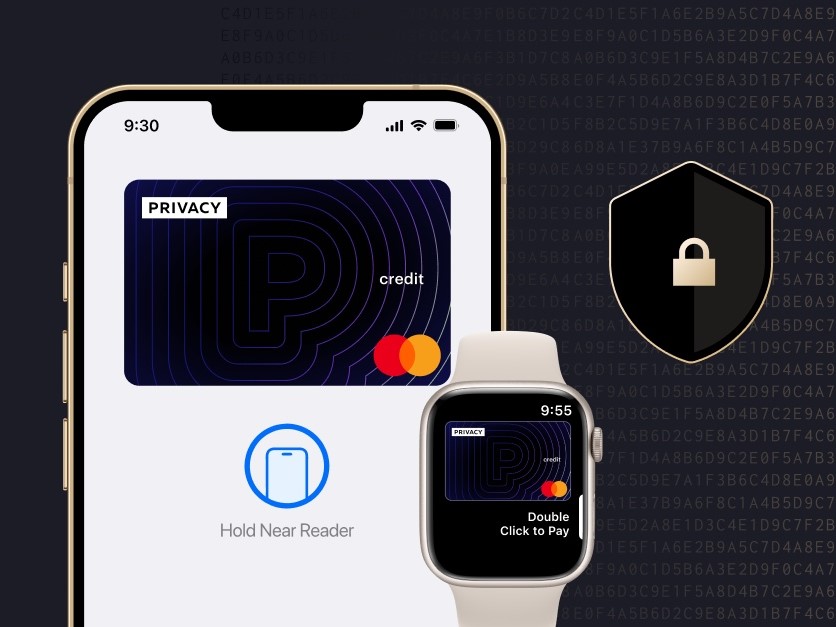

Digital Wallet Security & Compliance consulting is crucial for businesses integrating mobile payment systems, ensuring they meet the necessary security standards and compliance requirements. With digital wallets and mobile payments being prime targets for cybercriminals, businesses must implement stringent security measures to protect customer data. Consultants provide businesses with insights on implementing advanced encryption techniques, tokenization, and multi-factor authentication (MFA) to secure transactions. Additionally, they ensure that mobile payment solutions adhere to PCI DSS (Payment Card Industry Data Security Standard) and other industry regulations governing data protection. The service also involves ensuring compliance with laws such as GDPR (General Data Protection Regulation) in the EU or CCPA (California Consumer Privacy Act) in the U.S., which govern how businesses store, process, and manage customer data. Consultants also help businesses implement fraud prevention measures such as transaction monitoring, 3D Secure authentication, and other measures to reduce the risk of fraud. This ensures that the company’s digital wallet solutions are not only secure for consumers but also compliant with the latest legal and regulatory standards, reducing the risk of data breaches, fines, and reputational damage.

Racheal –

“I am highly impressed with the ‘Digital Wallet Security & Compliance’ advisory services. The expertise and guidance provided were exceptional, ensuring our mobile payment system and digital wallet adhere to stringent security regulations and data protection standards. This has significantly enhanced our compliance posture and customer trust. The thorough understanding of industry best practices and regulatory requirements was invaluable, providing us with peace of mind knowing that our payments ecosystem is secure and compliant.”

Abibat –

“Your ‘Digital Wallet Security & Compliance’ services have been invaluable in helping us navigate the complex regulatory landscape surrounding mobile payment systems. The advisory team provided expert guidance on compliance with security regulations and data protection standards, ensuring the integrity of our digital wallet solution. Their tailored approach and attention to detail have given us the confidence to launch our product with the highest levels of security and compliance, safeguarding our customers’ financial information.”

Tope –

“The ‘Digital Wallet Security & Compliance’ advisory service provided invaluable guidance in ensuring our digital payment systems met the highest security and compliance standards. Their in-depth knowledge and tailored solutions ensured seamless integration, safeguarding our customers’ sensitive data. Their dedication to protecting our digital ecosystem was evident throughout the engagement, enabling us to operate with confidence and provide our customers with peace of mind.”